Cost of Living in Singapore (2025): How Much Do You Need?

Singapore, a gleaming beacon of modernity and economic success, often evokes images of luxury and high-end living. While the city-state certainly offers a luxurious lifestyle for those who can afford it, it's not just a playground for the wealthy.

Singapore attracts people from all walks of life, drawn by its vibrant culture, safe environment, and diverse opportunities. However, the cost of living in Singapore is a common concern for those considering a move.

This guide aims to provide a comprehensive and realistic overview of living expenses in Singapore, helping you make informed decisions and plan your budget effectively.

Factors Affecting Cost of Living

Also Read: The Essential Guide to Moving to Singapore (2025)

It's important to understand that the cost of living in Singapore can vary significantly depending on several factors. Your lifestyle choices play a major role. If you prefer spacious, centrally located housing, frequent fine dining, and a busy social calendar filled with entertainment, your expenses will naturally be higher.

Family size and composition also influence your budget. A single individual will have different expenses compared to a couple or a family with children. Location within Singapore is another key factor. Living in the heart of the city, close to amenities and business districts, will generally be more expensive than living in the outskirts.

Accommodation

Housing is typically the biggest expense in Singapore. The city-state offers various housing options to suit different needs and budgets. Housing & Development Board (HDB) flats are government-subsidized apartments, a popular and affordable choice for Singaporeans and some permanent residents. Condominiums provide a more upscale living experience, often featuring amenities like swimming pools, gyms, and 24/7 security. Landed properties, such as terraced houses, semi-detached houses, and bungalows, offer more space and privacy but come with a significantly higher price tag.

Average rental costs vary considerably based on the type of housing, location, size, and amenities. A one-bedroom apartment in the city center can cost around S$2,500 to S$4,000 per month, while a similar apartment in the outskirts might be rented for S$1,500 to S$2,500. Condominiums and landed properties command even higher prices. To find affordable housing, consider living further from the city center, opting for a smaller unit, or sharing an apartment with roommates. Online portals like PropertyGuru, 99.co, and SRX Property are great resources for finding rental properties.

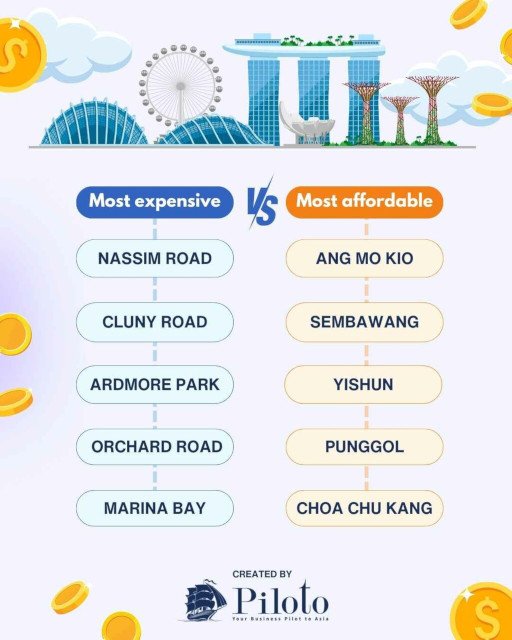

Here is a visualization of the most expensive and most affordable regions in Singapore.

While there are quite a few known expensive regions to live in when you’re in Singapore, there are also regions that belong to the other end of the spectrum - the most affordable regions to live in. Knowing which regions belong to which category is crucial to staying on top of the cost of living in Singapore.

Average rental costs vary considerably based on the type of housing, location, size, and amenities. A one-bedroom apartment in the city center can cost around S$2,500 to S$4,000 per month, while a similar apartment in the outskirts might be rented for S$1,500 to S$2,500. Condominiums and landed properties command even higher prices.

To find affordable housing, consider living further from the city center, opting for a smaller unit, or sharing an apartment with roommates. Online portals like PropertyGuru, 99.co, and SRX Property are great resources for finding rental properties.

Food

Singapore is a culinary melting pot, offering a tantalizing array of dining options. From hawker centers bustling with local flavors to Michelin-starred restaurants serving exquisite cuisine, there's something to please every palate and budget. Hawker centers and food courts are a budget-friendly option, where you can enjoy delicious local dishes for as low as S$5 to S$10 per meal. Restaurants offer a more refined dining experience, but prices can range from S$20 to S$100 or more per person, depending on the establishment.

Grocery shopping is generally much more affordable. Popular supermarkets include NTUC FairPrice, Cold Storage, and Sheng Siong. Cooking at home is a great way to save money on food, especially on a tight budget. To further reduce your food expenses, consider buying groceries in bulk, taking advantage of supermarket promotions, and packing your lunch instead of eating out every day.

Transportation

Singapore boasts an efficient and affordable public transportation system that makes getting around the city a breeze. The Mass Rapid Transit (MRT) is a comprehensive subway system that connects most parts of the island, offering a fast and convenient way to travel. Buses complement the MRT network, providing extensive coverage and frequent services. A single journey on the MRT or bus typically costs between S$1 and S$3, depending on the distance traveled. You can purchase an EZ-Link card, a stored-value card that allows for seamless travel on public transport.

Taxis and private hire cars like Grab are readily available but are a more expensive option compared to public transportation. Fares are calculated based on distance and time, and surcharges may apply during peak hours or for certain destinations. If you live and work in close proximity, consider walking or cycling as a healthy and cost-effective alternative.

Utilities

Utilities in Singapore are generally affordable compared to other major cities. Electricity, water, gas, and internet services are essential for any household. Average monthly costs for utilities can range from S$150 to S$300, depending on your usage and housing type. To conserve utilities and reduce costs, consider using energy-efficient appliances, turning off lights when leaving a room, and taking shorter showers.

Healthcare

Singapore's healthcare system is highly regarded for its quality and efficiency. Residents can choose between public and private healthcare providers. Public hospitals and polyclinics offer subsidized healthcare services to citizens and permanent residents, making healthcare more affordable. Private hospitals and clinics offer a wider range of services, shorter waiting times, and a more personalized experience, but at a higher cost.

Medical consultations, treatments, and hospital stays can be expensive, especially for those without health insurance. It's highly recommended to have health insurance coverage to manage potential medical expenses. Medisave, a national medical savings scheme, helps Singaporeans and permanent residents save for their healthcare needs.

Education

Education in Singapore is valued highly, and the education system is renowned for its rigor and academic excellence. Public schools are government-funded and offer affordable education for citizens and permanent residents. International schools cater to expat families and offer various curricula, such as the International Baccalaureate (IB) and British systems, but they come with a significantly higher cost. University tuition fees can also be substantial, especially for international students.

Other education-related expenses, such as books, uniforms, and extracurricular activities, can add to the overall cost. It's essential to factor in these costs when planning your budget, especially if you have school-aged children.

Entertainment and Leisure

Singapore offers a vibrant entertainment and leisure scene, with something for everyone. Movies, concerts, and other entertainment options can be expensive, but there are also plenty of free or low-cost activities available. Explore the numerous parks and gardens, visit museums and galleries, or attend community events to enjoy leisure activities without breaking the bank.

Other Expenses

In addition to the major categories mentioned above, there are other expenses to consider when calculating your cost of living in Singapore. Personal care, such as haircuts and beauty treatments, can vary in price depending on the salon or spa you choose. Clothing and shopping can also be a significant expense, especially if you enjoy designer brands or frequent shopping malls. Domestic help, such as cleaners or nannies, is common in Singapore but adds to your monthly expenses. Finally, don't forget about taxes. Singapore has a progressive tax system, with income tax rates ranging from 0% to 22%.

Monthly Budget Estimates

To give you a better idea of potential monthly expenses, here are estimated budgets for different lifestyles:

Single Person: S$2,500 - S$4,000 (includes rent, utilities, food, transportation, and basic entertainment)

Couple: S$4,000 - S$7,000 (includes rent, utilities, food, transportation, and moderate entertainment)

Family with Children: S$6,000 - S$10,000 or more (includes rent, utilities, food, transportation, education, and family activities)

These are just estimates, and your actual expenses may vary depending on your specific circumstances and choices.

Tips for Saving Money in Singapore

While Singapore can be an expensive city, there are ways to manage your budget and save money. Take advantage of the efficient public transportation system and walk or cycle whenever possible. Cooking at home more often and packing your lunch can significantly reduce your food expenses. Look for free or low-cost entertainment options, such as visiting parks, museums, and community events. Shop around for the best deals on groceries and other essentials, and consider buying in bulk to save money.

If you're flexible with your housing choices, consider living outside the city center, where rental costs are generally lower. Take advantage of government subsidies and schemes that can help offset certain expenses, such as healthcare and education.

Taxes and Other Miscellaneous Costs

Singapore’s tax system is favorable for expats, with relatively low personal income tax rates compared to many Western countries.

Personal Income Tax: Tax rates for residents range from 0% to 22%, depending on income levels. Non-residents are taxed at a flat rate of 15% or the progressive resident rates, whichever is higher.

Goods and Services Tax (GST): Singapore imposes a 8% GST on most goods and services, which may increase your day-to-day living costs.

Miscellaneous Costs: Other expenses like clothing, household goods, and personal care products can add up depending on your lifestyle choices. For a single person, miscellaneous monthly costs may range from SGD 200 to SGD 400.

Summary of Average Monthly Expenses

Here’s a rough estimate of the monthly cost of living for a single expat and a family of four in Singapore:

Single Expat: SGD 3,500 to SGD 6,000 per month

Family of Four: SGD 6,000 to SGD 12,000 per month

These figures vary depending on housing choices, lifestyle, and family size, but they offer a good baseline for budgeting your move to Singapore.

Conclusion

While the cost of living in Singapore can be high, especially when it comes to housing and education, the city offers a high quality of life, excellent healthcare, and world-class infrastructure. By understanding the different costs associated with daily life, expats can better prepare and manage their finances in this vibrant city.

If you're considering making the move to Singapore, be sure to check out our Move to Singapore guide for more insights into the relocation process and other key information to help you settle in the Lion City.